Free printable budget spreadsheets can make navigating the world of finances easier, especially when it comes to budgeting and keeping tabs on where every dollar goes each month. It can often feel like trying to solve a puzzle with missing pieces, but these spreadsheets help you stay organized and on top of your finances.

It’s easy to feel like you’re in over your head, but trust me, this is an all-too-common experience.

As someone who has sifted through a myriad of recommendations and gimmicks in search of something that wouldn’t just add another expense, I understand how daunting managing money can be.

Interestingly enough, did you know that simply using a budget sheet could potentially help folks save as much as 20% on their monthly expenditures? This happens because they start paying attention to their spending patterns.

After plenty of searching—and let’s be real—a fair share of trial-and-error on my part, I’ve come across a collection of no-cost printable budget sheets that truly made a difference in how I handle my personal finances.

And here’s the good news: they stand ready to help transform yours too. In this discussion we’ll explore various templates crafted with the goal of making your financial planning smoother and more intuitive.

If you’re eager for change and yearn for clarity in your financial life, then buckle up—as we’re about to embark on this journey together!

Key Takeaways

- Use free printable budget sheets to track spending and save up to 20% on monthly expenses.

- Digital tools like Google Sheets templates and budgeting apps can help manage your money.

- Printable personal, family, household, and bill tracker templates organize different financial needs.

- Tracking expenses regularly allows for necessary adjustments to stay within your budget.

- Keep all printable resources in a binder with dividers for easy access and organization.

Understanding Free printable budget spreadsheets

Budgeting is essential for financial planning, as it helps you track your expenses and prioritize your spending. By following basic budgeting principles, you can take control of your finances and work towards achieving your financial goals.

Importance of budgeting

Budgeting helps me take charge of my finances. I set clear financial goals and make sure I’m working towards them every month. It’s like having a roadmap for where my money should go, which keeps me out of debt and saves for the future.

By planning how to spend my income, I avoid unnecessary stress about money.

Staying on top of expenses is easier with a budget. I know exactly what comes in and goes out, so there are no surprises. This way, it’s simpler to spot areas where I can cut back and save more cash.

With a good budget plan, managing money becomes less overwhelming and more empowering.

I use budget templates to help organize my spending habits better. They show me when bills are due so nothing slips through the cracks. Seeing all my costs on paper or a screen makes it simple to adjust as life changes.

Money management printables have been lifesavers for keeping everything transparent and under control.

Basic budgeting principles

Budgeting is crucial for managing finances effectively. It involves tracking income and expenses, setting financial goals, and creating a plan to achieve them. Understanding one’s financial situation is essential in developing an effective budget.

Managing a budget requires discipline and consistency. Tracking regular expenses like groceries, bills, and other essentials helps in identifying spending patterns. Budgeting also involves prioritizing needs over wants while saving money for the future.

Creating a realistic budget that aligns with personal financial goals is key to successful money management. It allows individuals to allocate funds for savings, debt repayment, and emergencies while ensuring that their spending remains within their means.

Free Digital printable budget spreadsheets

When it comes to budgeting, there are plenty of digital resources available to help you stay organized and on track. From Google Sheets templates to budgeting apps, these tools can make it easier to manage your finances.

Google Sheets templates

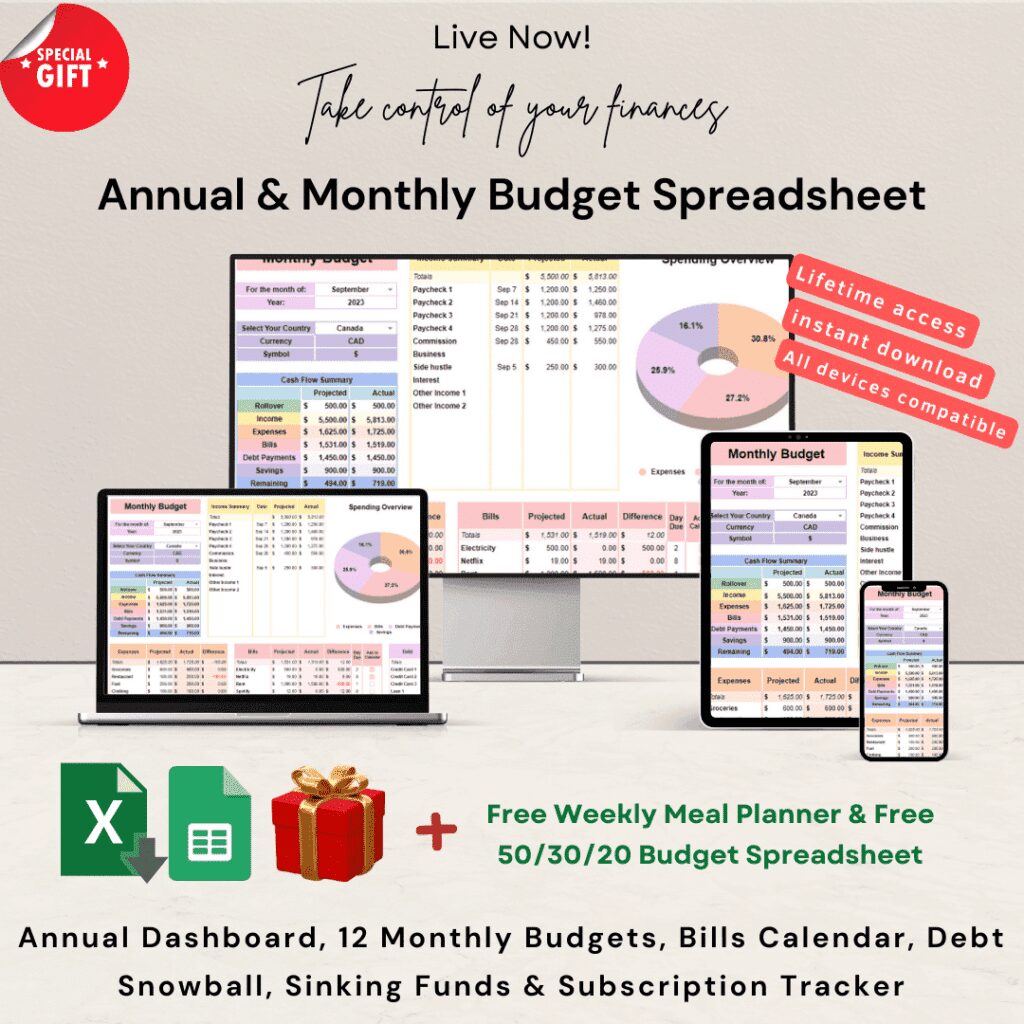

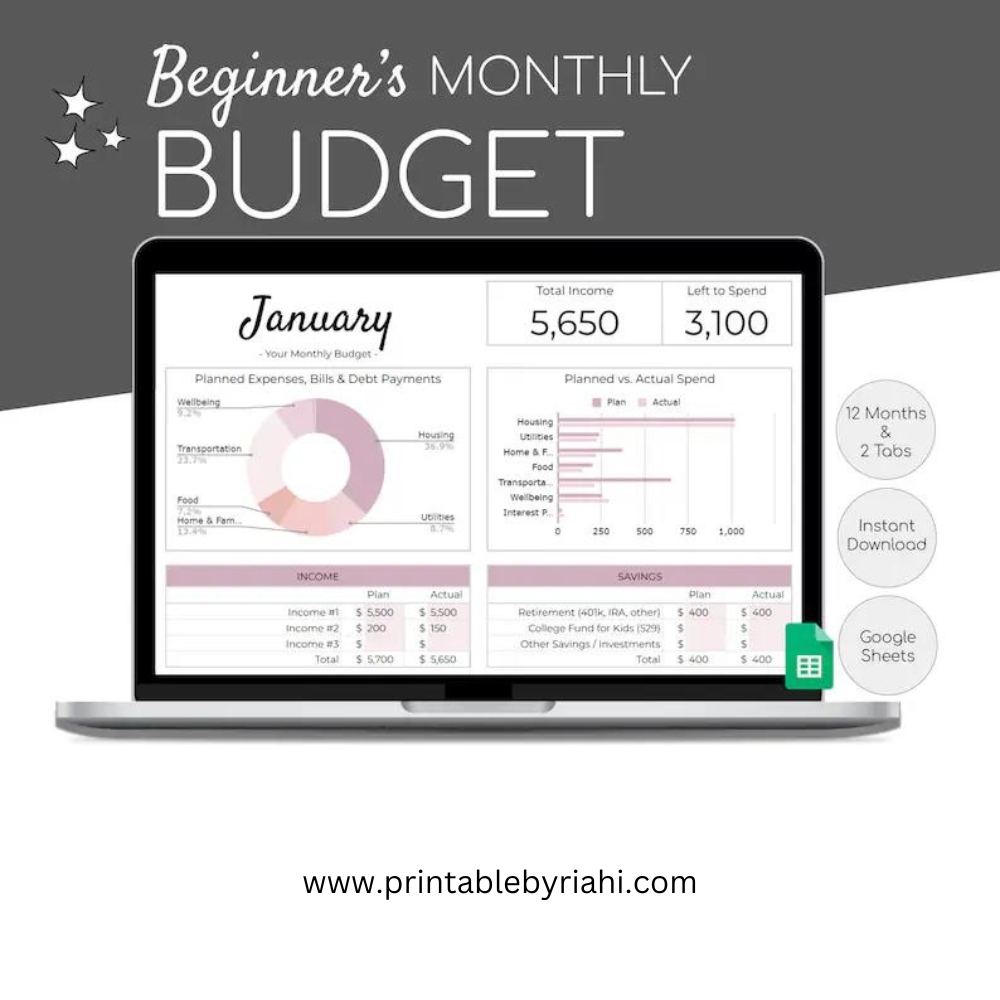

Google Sheets templates are versatile tools for budgeting and financial planning. These templates offer customizable spreadsheets to track expenses, income, and savings. With features like auto-calculation functions and interactive graphs, they simplify the process of managing personal finances.

Household budget planners and monthly expense trackers are readily available, making it easier to create a comprehensive budget plan tailored to individual needs. Additionally, these templates can be easily accessed from any device with internet connection, allowing for real-time updates and collaboration with family members or financial advisors.

By utilizing Google Sheets templates as financial planning tools, one can effectively organize income and expenditure data in a single location. This promotes better expense tracking while providing clear visuals on spending patterns over time using charts and graphs—essential for ensuring that financial goals align with actual spending habits.

Budgeting apps

There are numerous budgeting apps available to streamline financial planning. These apps offer features like expense tracking, bill reminders, and goal setting. They can sync with bank accounts to provide real-time expenditure updates.

The convenience of budgeting apps allows for easy access to financial information on-the-go. Some even offer tools for analyzing spending patterns and creating customized budgets tailored to individual needs.

With the availability of these apps across various devices, staying on top of personal finances has never been easier.

Free Printable Budget Templates

Find a variety of free printable budget templates to suit your individual or household needs, including personal budget templates, family and household budget templates, and bill tracker templates.

These resources will help you stay organized and on track with your financial goals.

Personal budget templates

Personal budget templates are essential for managing personal finances effectively. These templates help in tracking income and expenses, identifying areas for saving, and setting financial goals.

By using these tools, I can easily create a detailed overview of my spending habits and find ways to improve my financial situation.

These templates come in various formats such as printable sheets or digital spreadsheets, offering flexibility based on individual preferences. With the help of these budgeting tools, I am able to customize categories based on my specific needs and monitor my progress towards achieving financial stability.

Family & household budget templates

Transitioning from personal budget templates to family and household budget templates, I’ve found that these free printable sheets can be incredibly helpful for managing the finances of a whole household.

From tracking monthly bills to planning for unexpected expenses, these templates are designed with families in mind. They provide sections for various aspects such as groceries, utilities, insurance, and even savings for family vacations or special occasions.

By utilizing these budgeting tools, it becomes easier to stay on top of expenses and work toward achieving the financial goals set as a family.

These free downloadable budget templates create an organized way to manage income and expenditures while ensuring everyone in the household is aware of the overall financial plan. With clear categorization and easy-to-use formats, they make it simpler to track spending habits and identify areas where adjustments may be needed.

Subscribe today and get a special gift, just for you!

Bill tracker templates

Transitioning to bill tracker templates, they are a crucial tool in managing personal finances. These templates help me track my recurring bills such as utilities, rent or mortgage, and subscriptions.

By using bill tracker templates, I can ensure that all my bills are paid on time and avoid late fees that could impact my financial goals.

Moreover, these templates allow me to monitor irregular expenses like medical bills or home repairs which helps me plan and adjust my budget effectively. With bill tracker templates, I am able to maintain a clear overview of my financial obligations and allocate funds accordingly without any last-minute stress or surprises impacting my budget.

Tips for Using Printable Budget Sheets

Organizing and setting financial goals can help provide direction for your budgeting efforts. Tracking expenses and adjusting your budget as needed is key to staying on track with your financial plans.

Utilizing budget binder resources can help keep all of your printables organized and easily accessible.

Organizing and setting financial goals

To organize and set financial goals, start by listing short-term and long-term objectives. Create a plan for budgeting, saving, and investment to achieve these goals. By using printable budget sheets to track income and expenses, it becomes easier to allocate funds towards specific financial targets.

Setting realistic and measurable goals helps in staying focused on achieving them effectively. Regularly reviewing progress against the set financial goals allows for necessary adjustments to be made if needed.

Setting clear financial objectives aids in prioritizing spending, reducing unnecessary expenses, and increasing savings. It also provides a sense of direction for better managing personal finances while working towards a stable financial future.

Tracking expenses and adjusting budget

To manage my budget effectively, I track all my expenses and regularly review them. This allows me to identify areas where I may be overspending and make necessary adjustments to stay within my budget.

By keeping a close eye on my spending, I can ensure that I am meeting my financial goals and making the most of my income.

I adjust my budget as needed based on the insights gained from tracking expenses. This helps me allocate funds appropriately towards savings, debt management, and other priorities.

Utilizing budget binder resources

I organize my budget sheets in a binder with dividers for easy access. Using clear sheet protectors, I keep my printable budget templates safe from wear and tear. This helps me stay organized and focused on my financial goals.

To manage the variety of resources I use, I label each section in the binder based on their purpose. For example, I separate my personal budget worksheets from family and household budgeting templates for quick reference.

Keeping everything in one place makes it simpler to track expenses, review savings progress, and adjust budgets when needed.

By utilizing these simple organizational tools, managing my finances becomes more straightforward and less overwhelming.

Conclusion

In conclusion, take charge of your finances with these free printable budget sheets. Get organized and set financial goals to achieve a secure future. Start tracking your expenses and adjust your budget as needed.

Utilize the available resources to create a strong foundation for financial stability.

FAQs

1. What are free printable budget sheets for financial planning?

Free printable budget sheets for financial planning are tools like templates and worksheets that help you track expenses, manage income, and plan your savings.

2. How do these budgeting tools help in managing finances?

These tools, including expense tracking templates and personal finance worksheets, assist you in organizing your finances by setting clear financial goals and monitoring your spending patterns.

3. Can I use a budget sheet to plan my savings?

Yes! Savings and budgeting tools found on these printable sheets can guide you to set aside money regularly to reach your savings target effectively.

4. Are there special templates for setting my financial goals?

Indeed! There are specific financial goal-setting templates designed to outline your objectives clearly so you can work towards them with a structured approach.