Introduction to Budgeting by Paycheck

Budget by Paycheck Printable is a transformative approach to managing your finances. It’s more than just a method; it’s a journey towards financial clarity and empowerment. This strategy breaks down your budget based on each paycheck, making it easier to handle expenses, savings, and investments in manageable chunks.

Understanding the Concept

The paycheck budgeting method involves allocating your income from each paycheck towards specific expenses, savings, and debt repayment. This approach offers a clear view of where your money is going, ensuring that every dollar has a purpose.

Why It’s Effective for Financial Management

Budget by paycheck aligns your expenses with your income schedule, making it easier to avoid overspending and under-saving. It’s particularly beneficial for those who struggle with monthly budgeting or have irregular income patterns.

The Basics of a Paycheck Budget

At its core, a Budget by paycheck is about matching your expenses with your income.

Definition and Key Components

A Budget by paycheck consists of several key components: income, fixed expenses, variable expenses, savings, and debt repayment. By understanding these elements, you can create a budget that fits your financial situation.

Benefits of Budgeting Each Paycheck

This method offers numerous benefits, including improved cash flow management, reduced financial stress, and a clearer path to achieving your financial goals.

Setting Up Your Budget by paycheck: Step-by-Step

Creating a paycheck budget requires a bit of planning and organization.

Getting Started: What You Need

Start with gathering your financial documents: pay stubs, bills, and any other income or expense statements.

Step-by-Step Guide to Creating a Budget by paycheck

- Calculate Your Income: Determine your total income for each paycheck.

- List Your Expenses: Categorize them into fixed and variable.

- Assign Expenses to Paychecks: Allocate funds from each paycheck to cover your expenses.

- Plan for Savings and Debt Repayment: Decide how much you can save and pay towards debts.

- Review and Adjust: Regularly review your budget and adjust as needed.

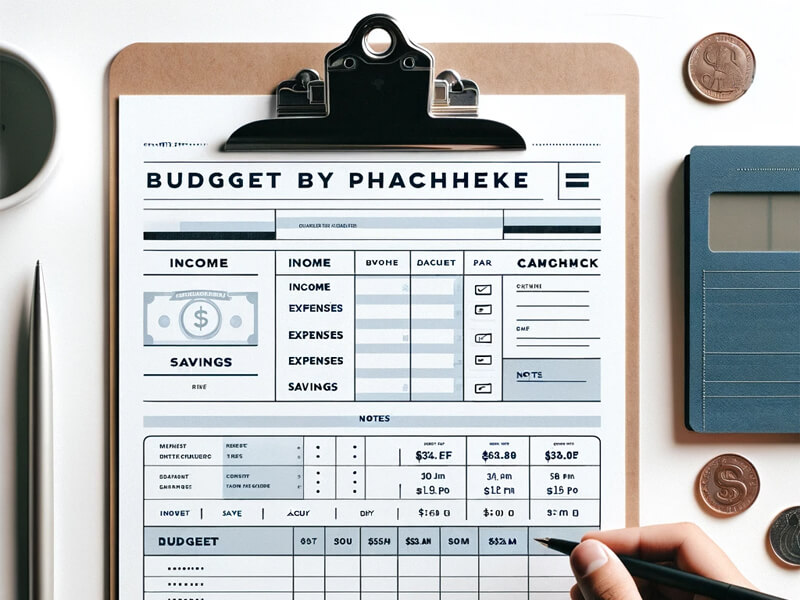

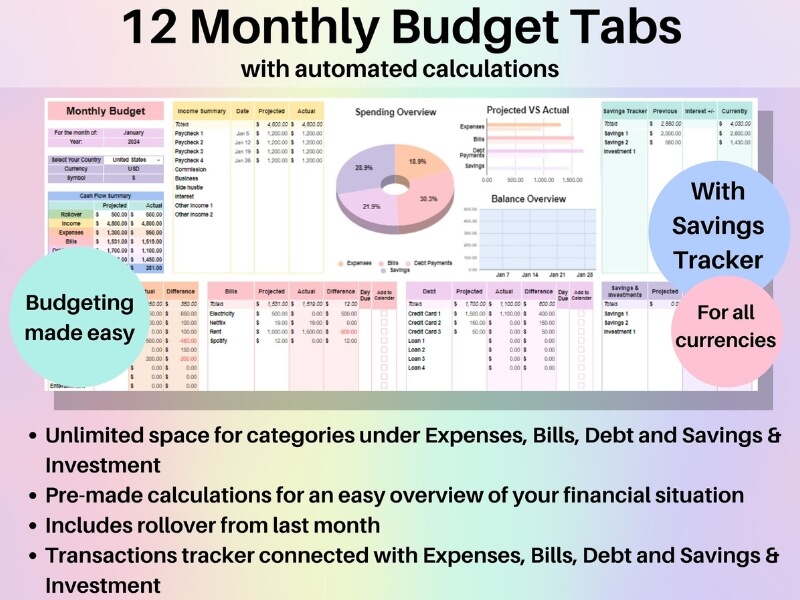

Customizable Budget by Paycheck Printables

Using printables can greatly simplify the budgeting process.

What Are Budget Printables?

Budget printables are pre-designed templates that you can use to track your income, expenses, savings, and debts.

How They Simplify the Budgeting Process

These tools provide a visual representation of your finances, making it easier to see where your money is going and identify areas for improvement.

Designing Your Budget Printable: Tips and Tricks

Creating a budget printable that works for you involves understanding your unique financial situation.

Essential Elements to Include

Your printable should have sections for income, fixed and variable expenses, savings, and debts. Consider including a section for notes or unexpected expenses.

Creative Ideas for Personalization

Personalize your printable with color coding, different sections for each type of expense, or motivational quotes to keep you inspired.

Digital vs. Printable Budgeting Tools

Both digital and printable tools have their merits.

Pros and Cons of Each

- Digital Tools: Offer automation and syncing with bank accounts but may lack personalization.

- Printable Tools: Provide a hands-on approach and customization but require manual updating.

How to Choose What’s Right for You

Consider your lifestyle, tech-savviness, and personal preference when choosing between digital and printable budgeting tools.

How to Track Your Spending Effectively

Effective spending tracking is crucial for a successful budget.

Methods for Tracking Expenses

You can track expenses manually, use apps, or a combination of both. The key is consistency and accuracy.

Using Printables to Monitor Spending

Printables are excellent for those who prefer a

tangible record of their spending. Regularly updating your printable with each expense ensures you stay on top of your financial situation.

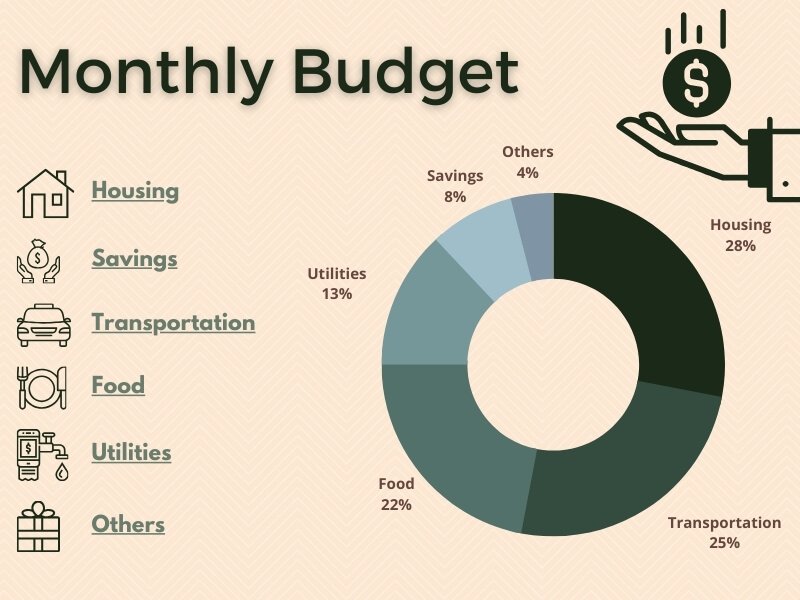

Allocating Funds in Your Budget

Effective allocation is critical in paycheck budgeting.

Strategies for Effective Allocation

- Prioritize essential expenses like rent and groceries.

- Allocate funds for savings and debt repayment.

- Set aside a portion for discretionary spending.

Examples of Allocation Methods

You might choose a percentage-based allocation or a fixed-amount approach, depending on your income and expense patterns.

Dealing with Irregular Income

Budgeting with a fluctuating income can be challenging but is achievable with the right strategies.

Budgeting Tips for Freelancers and Contractors

- Base your budget on your lowest-expected income.

- Create an emergency fund for leaner months.

- Adjust your budget as your income varies.

Adapting the Printable Budget for Variable Paychecks

Customize your printable to accommodate fluctuations, with sections for ‘expected’ and ‘actual’ income and expenses.

Savings Strategies in Budget by paycheck

Incorporating savings into your budget is essential for long-term financial health.

Setting Savings Goals

Define clear, achievable goals, whether it’s an emergency fund, vacation, or retirement savings.

Tips for Consistent Saving

- Automate your savings.

- Start small and increase gradually.

- Treat savings as a non-negotiable expense.

Managing Debt While Budgeting by Paycheck

Balancing debt repayment with other financial obligations is crucial.

Strategies for Debt Reduction

- Use the snowball or avalanche method.

- Allocate a portion of each paycheck towards debts.

- Prioritize high-interest debts.

Incorporating Debt Payments into Your Budget

Ensure your budget printable has a dedicated section for debt repayment to keep track of your progress.

Expense Tracking and Analysis

Regular analysis of your spending patterns can offer valuable insights.

Tools and Techniques for Expense Analysis

Use apps, spreadsheets, or paper-based methods to analyze your spending habits.

Interpreting Data for Better Budgeting

Look for patterns, such as overspending in certain categories, to make informed adjustments to your budget.

Adjusting Your Budget Over Time

Your financial situation will evolve, and so should your budget.

When and How to Update Your Budget

Regularly review and adjust your budget, especially after major life changes like a new job or a move.

Reacting to Financial Changes

Be flexible and willing to modify your budget as your income, expenses, and financial goals change.

Common Mistakes in Paycheck Budgeting

Awareness of potential pitfalls can help you avoid them.

Identifying and Avoiding Pitfalls

Common mistakes include underestimating expenses, neglecting savings, and failing to adjust the budget as needed.

Learning from Budgeting Errors

Use mistakes as learning opportunities to refine your budgeting skills.

Expert Advice on Budget by paycheck

Insights from financial experts can offer additional guidance.

Insights from Financial Planners

Professional advice can tailor your budgeting approach to your unique financial situation.

Success Stories and Case Studies

Real-life examples provide inspiration and practical tips for successful paycheck budgeting.

Resources and Tools for Budget by paycheck Planning

Leverage available resources for enhanced budget management.

Top Budgeting Apps and Helpful Websites

Explore apps and websites that offer budgeting tools, templates, and educational content.

Printable Templates and Guides

Look for printable budget templates that suit your style and needs.

Take Control of Your Finances Now!

Embark on your journey to financial empowerment with our comprehensive guide on ‘Budget by Paycheck Printable’. Don’t just read about financial freedom – achieve it! Start implementing these proven strategies and use our practical, customizable printables to manage your finances like a pro. Say goodbye to financial stress and hello to clarity and confidence in your money management skills.

👉 Download Your Free Budget Printable Today and Transform Your Financial Future!

Budget by Paycheck Printable FAQs

Addressing common questions can clarify doubts and provide additional insights.

- How often should I update my budget printable? Update your budget printable every time you receive a paycheck or incur a significant expense.

- Can I use a paycheck budget if I have a variable income? Yes, it requires more flexibility and may involve averaging your income over several months.

- How can I make my budget printable more effective? Regularly review and adjust it, ensuring it aligns with your current financial situation.

- What should I do if I consistently overspend in a category? Reevaluate your budget allocations and look for ways to reduce

expenses or reallocate funds from other categories