Are you tired of living paycheck to paycheck, feeling like your financial goals are always out of reach? It’s time to take control of your money and master your finances with a free 50-30-20 budget template on Google Sheets. With this powerful tool, you can finally stop the endless cycle of financial stress and start progressing towards your goals.

Table of contents

Subscribe now!

Ready to level up? Discover more tips and templates to maximize productivity and streamline your life!

Subscribe now!

Subscribe now for tips and templates to boost your productivity and life!

The free 50-30-20 budgeting method is a simple yet effective way to manage money. It breaks down your income into three categories:

- 50% for essentials like housing and bills

- 30% for personal wants and desires

- 20% for savings and debt repayment

By following this budget, you can ensure that your needs are met, indulge in some of life’s luxuries, and still have money left to build a secure financial future.

Using a budget template on Google Sheets makes staying organized and tracking your progress even more accessible. You can easily input your income and expenses, set savings goals, and monitor your spending all in one place. Plus, with the convenience of syncing across devices, you can access your budget anytime, anywhere.

Don’t let your finances control you any longer. Take charge today with a free 50-30-20 budget template on Google Sheets and start achieving your financial goals.

How the 50-30-20 Budget Works

The 50-30-20 budgeting method is a straightforward approach to managing your finances. It divides your income into three main categories: 50% for essentials, 30% for personal wants, and 20% for savings and debt repayment. This method provides a clear framework for spending and saving, ensuring you cover your basic needs, enjoy some discretionary spending, and still have money left to build financial security.

When you allocate 50% of your income to essentials, you prioritize what you need to live comfortably. This includes housing costs, utilities, transportation, groceries, and other necessary expenses. Setting this as the baseline for your budget ensures that your basic needs are met without overspending.

The next category, 30% for personal wants, allows you to indulge in the things that bring you joy and fulfillment. These can include dining out, entertainment, shopping, hobbies, and travel. Allocating a portion of your income to these discretionary expenses is important to maintain a healthy work-life balance and enjoy your hard-earned money.

Finally, the remaining 20% of your income is dedicated to savings and debt repayment. This is where you prioritize your financial goals and work towards building a secure future. Whether saving for emergencies, retirement, or paying off debt, this category ensures you progress toward your long-term financial objectives.

Following the 50 30 20 budget creates a balanced approach to managing your money. It allows you to cover your essential needs, enjoy some personal wants, and save for the future. This method provides a clear structure for your finances, giving you control over your money and helping you achieve your financial goals.

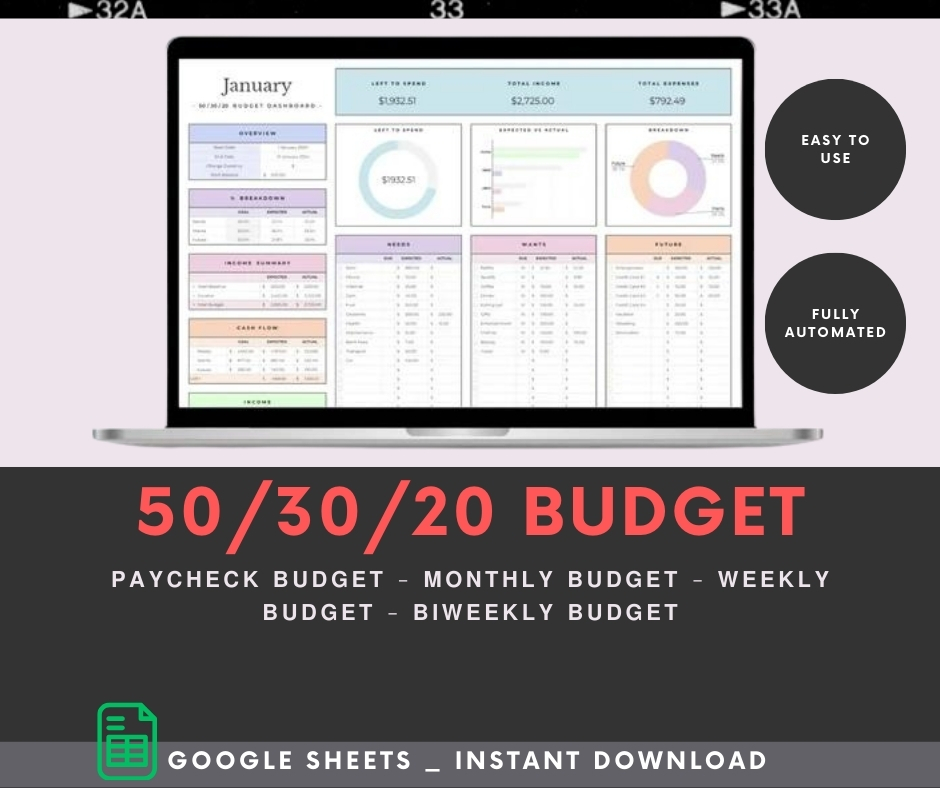

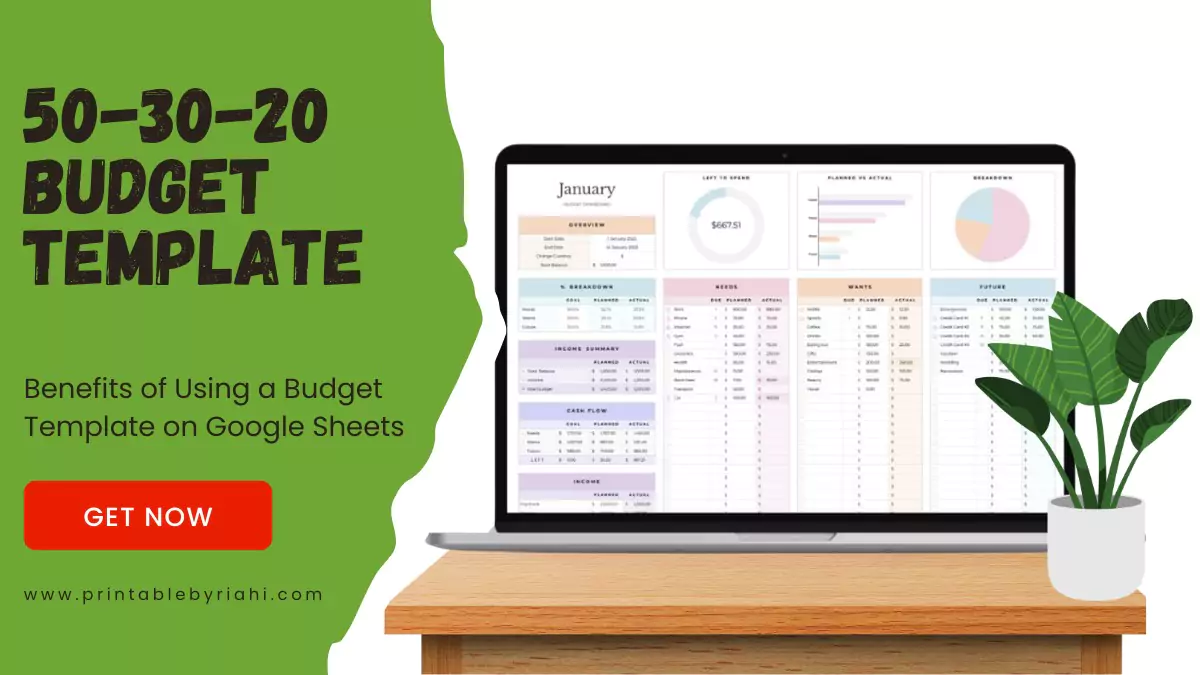

Benefits of Using a Budget Template on Google Sheets

Using a budget template on Google Sheets offers a range of benefits that can streamline your financial management process. Here are some key advantages:

- Accessibility and convenience: Google Sheets allows you to access your budget anywhere with an internet connection. Whether at home, work, or on the go, you can easily view and update your budget on any device. This accessibility ensures that you always have your financial information at your fingertips.

- Real-time syncing: With Google Sheets, your budget automatically syncs across devices, ensuring you have the most up-to-date information. If you input an expense on your smartphone, it will instantly appear on your computer and any other devices connected to your Google account. This real-time syncing eliminates the need for manual updates and reduces the risk of errors or discrepancies.

- Customization options: Google Sheets offers a wide range of customization options to tailor your budget template to your needs. You can easily add or remove categories, change formatting, and adjust formulas to fit your preferences. This flexibility allows you to create a budget template that works best for you.

- Automatic calculations: Google Sheets has built-in formulas that automatically calculate totals, track expenses, and provide a clear overview of your financial situation. This saves you time and effort compared to manually calculating and updating your budget. You can see your income, expenses, and savings progress in real-time with the click of a button.

Follow me on Facebook for updates, exclusive content, and more! Stay connected and don't miss out on all the exciting posts. Click Follow now!

Using a budget template on Google Sheets helps you stay organized and simplifies the budgeting process. With its accessibility, syncing capabilities, customization options, and automatic calculations, Google Sheets provides a powerful tool for managing your finances effectively.

Setting Up Your Free 50-30-20 Budget Template on Google Sheets

Now that you understand the basics of the 50 30 20 budget and the benefits of using Google Sheets, it’s time to set up your budget template. Follow these steps to get started:

- Create a new Google Sheets document: Open Google Sheets and create a new document for your budget. You can choose a blank template or search for budget templates in the Google Sheets template gallery.

- Set up your income and expense categories: Create columns for your income sources and expense categories. You can customize these based on your specific financial situation. Some common income categories include salary, side hustle, and investment income. Expense categories may include rent/mortgage, utilities, groceries, transportation, entertainment, etc.

- Input your income and expenses: Fill in the income and expense columns with the appropriate amounts. Be sure to include all sources of income and track your costs accurately. You can add formulas to calculate totals and track your progress automatically.

- Allocate your income to the different categories: Divide your income based on the 50-30-20 budgeting method. Allocate 50% to essentials, 30% to personal wants, and 20% to savings and debt repayment. Use formulas to calculate these amounts automatically based on your income.

- Set savings goals: Determine your savings goals and create a separate column to track your progress. Whether saving for emergencies, a vacation, or paying off debt, setting specific goals can help you stay motivated and focused on achieving them.

✨ Follow me on Pinterest for more inspiration, creative ideas, & endless possibilities! ?✨Discover unique content, DIY projects, and so much more! Don’t miss out — click Follow now!

Once you’ve set up your Free 50-30-20 budget template on Google Sheets, you can start tracking your income and expenses, allocating your income to the different categories, and working towards your financial goals.

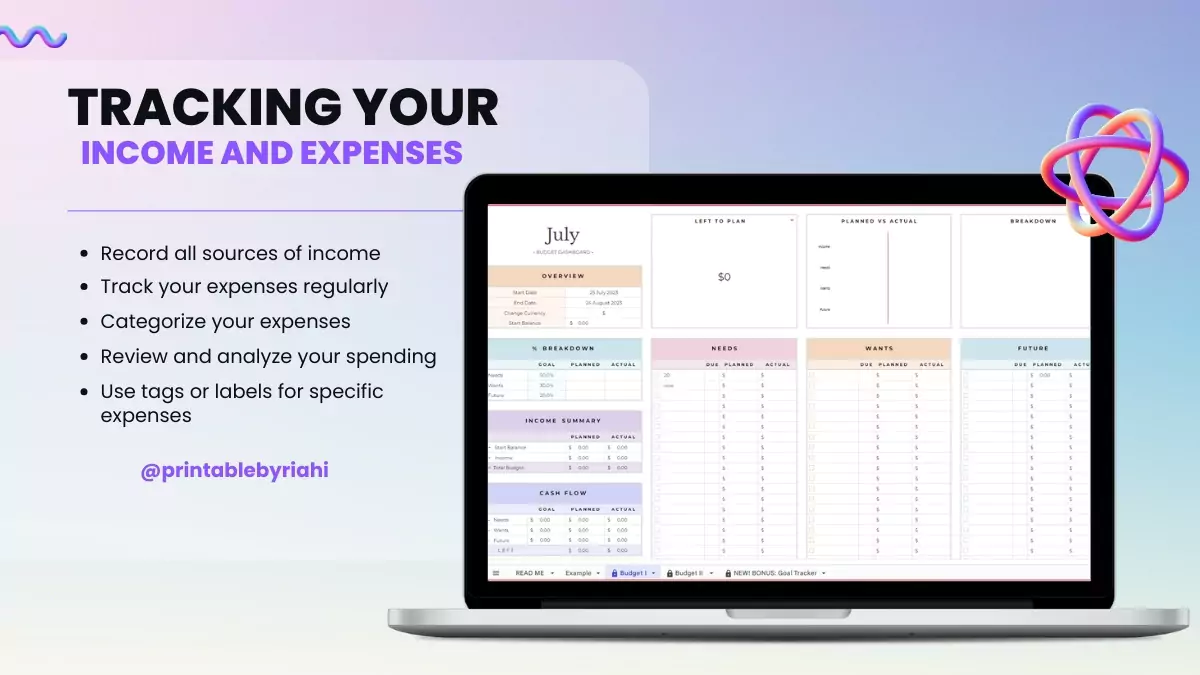

Tracking Your Income and Expenses

One key component of successful budgeting is tracking income and expenses. By monitoring your cash flow, you understand where your money is coming from and where it’s going. This knowledge allows you to make informed decisions about your spending and identify areas where you can adjust to meet your financial goals.

To track your income and expenses effectively, follow these tips:

- Record all sources of income: Make sure to accurately record all sources of income, including your salary, side hustle earnings, investment income, and any other income streams. This ensures that you have a complete picture of your cash inflow.

- Track your expenses regularly: Record your expenses consistently as they occur. This can be done daily, weekly, or monthly, depending on your preference. The key is to stay consistent and not let any expenses slip through the cracks.

- Categorize your expenses: Assign each expense to the appropriate category in your budget template. This will help you analyze your spending patterns and identify areas where you may be overspending or can make adjustments.

- Use tags or labels for specific expenses: If you want to track particular expenses separately, consider using tags or labels. For example, you can tag dining out, entertainment, or shopping expenses to see how much you’re spending in each category.

- Review and analyze your spending: Regularly review your expenses to identify patterns or trends. Are there any categories where you consistently overspend? Are there areas where you can cut back? This analysis will help you make informed decisions about your spending habits.

By diligently tracking your income and expenses, you gain valuable insights into your financial habits and can adjust to align with your financial goals. Staying disciplined and consistent with your tracking is essential to maintain an accurate and up-to-date budget.

Allocating Your Income to the Different Categories

Once you’ve tracked your income and expenses, it’s time to allocate your income to the different categories of the Free 50-30 20 budget. This step ensures that you stay within the recommended percentages and prioritize your financial goals.

To allocate your income effectively, follow these steps:

- Calculate your income: Determine your total revenue for your budgeting period. Depending on how often you receive paychecks, this can be your monthly, biweekly, or weekly pay.

- Determine your essentials: Multiply your income by 50% to calculate the amount you should allocate to essentials. These include expenses like rent/mortgage, utilities, groceries, transportation, and insurance. Make sure your essential expenses are within the 50% limit.

- Calculate your wants: Multiply your income by 30% to determine the amount you can allocate to personal wants. This category covers discretionary expenses like dining out, entertainment, hobbies, and shopping. This is your opportunity to indulge in the things that bring you joy and fulfillment.

- Allocate to savings and debt repayment: Multiply your income by 20% to calculate the amount you should allocate to savings and debt repayment. This category is crucial for building financial security and paying outstanding debts. Set specific savings goals and allocate a portion of this 20% to each goal.

- Adjust as needed: If your income or expenses change, make adjustments to ensure you stay within the 50, 30, and 20 percentages. Regularly review your budget and make changes as necessary to reflect your current financial situation.

By allocating your income to the different categories of the 50 30 20 budget, you create a clear plan for your money. This ensures that you prioritize your needs, enjoy some discretionary spending, and work towards your long-term financial goals.

Tips for Sticking to Your Budget

Creating a budget is one thing, but sticking to it can be challenging. However, with the right mindset and strategies, you can make your budget a successful tool for managing your finances. Here are some tips for staying on track:

- Set realistic goals: Make sure your budget aligns with your financial goals and is realistic based on your income and expenses. Setting unrealistic expectations can lead to frustration and make it challenging to stick to your budget.

- Track your spending regularly: Track your spending regularly to stay on top of it. This will help you identify areas where you’re overspending and allow you to make adjustments as needed.

- Practice mindful spending: Ask yourself if it aligns with your budget and financial goals before purchasing. Consider whether it’s a necessity or a want. Mindful expenditures can help you avoid impulsive purchases and stay within your budget.

- Automate savings and debt payments: Set up automatic transfers to your savings account and automatic payments towards your debts. This ensures you’re consistently saving and making progress on debt repayment without requiring manual transfers.

- Reward yourself: Budgeting doesn’t mean depriving yourself of all pleasures. It’s important to reward yourself for staying on track with your budget. Set aside a small portion of your personal wants category for occasional treats or rewards.

- Please review and adjust your budget: Review it regularly to ensure it aligns with your financial goals and lifestyle. If necessary, adjust it to accommodate any changes in your income or expenses.

Implementing these tips can increase your chances of sticking to your budget and achieving your financial goals. Remember, budgeting is a long-term commitment, and it takes time to develop new habits. Stay persistent and focused on the bigger picture.

Monitoring Your Progress and Adjusting Your Budget

Monitoring your progress is crucial to ensure that your budget is working for you and helping you achieve your financial goals. By regularly reviewing your budget, you can identify areas for improvement, make necessary adjustments, and stay on track. Here’s how to effectively monitor your progress and adjust your budget:

- Track your savings and debt repayment: Continuously monitor your progress toward your savings goals and debt repayment. Check if you’re consistently allocating the intended amount to these categories and progressing according to your timeline.

- Analyze your spending patterns: Review your spending patterns to identify areas where you may be overspending or where you can make adjustments. Look for recurring expenses you can reduce or remove from your budget.

- Consider changes in income or expenses: If your income increases or decreases, or if your costs change significantly, adjust your budget accordingly. This ensures that your budget remains realistic and aligned with your financial situation.

- Revisit your financial goals: Regularly reassess them to ensure they’re still relevant and achievable. Adjust your savings targets or add new goals to your budget if necessary.

- Seek accountability and support: Find an accountability partner or join a community of like-minded individuals working towards their financial goals. Sharing your progress, challenges, and successes can provide motivation and support.

Monitoring your progress and adjusting your budget ensures that it remains effective and aligned with your financial goals. By staying proactive and making necessary changes, you can continue to make progress towards financial freedom.

Additional Features and Customization Options in Google Sheets

Google Sheets offers a range of additional features and customization options that can enhance your budgeting experience. Here are some features to explore:

- Conditional formatting: Use conditional formatting to highlight certain cells based on specific conditions automatically. For example, you can underline expenses that exceed a certain threshold or savings goals that have been achieved.

- Charts and graphs: Create visual representations of your budget data using charts and graphs. This can help you visualize your spending patterns, track your progress, and identify areas for improvement.

- Importing transactions: If you have transaction data from your bank or credit card statements, you can import them into Google Sheets to automate the tracking process. This can save you time and ensure accuracy.

- Collaboration: If you’re sharing your budget with a partner or family member, you can invite them to collaborate on the Google Sheets document. This allows for real-time collaboration and ensures everyone is on the same page.

- Mobile apps: Google Sheets offers mobile apps for iOS and Android devices. These apps provide a convenient way to access and update your budget on the go.

Take advantage of these additional features and customization options in Google Sheets to make your budget template even more effective and tailored to your needs.

Subscribe today and get a special gift, just for you!

Conclusion and Final Thoughts on Using the 50 30 20 Budget Template

Mastering your finances and achieving your goals is within your reach with the help of a 50-30-20 budget template on Google Sheets. By following this simple yet effective budgeting method, you can prioritize your needs, indulge in personal wants, and save for the future.

Google Sheets provides a powerful platform for managing your budget, offering accessibility, convenience, and a range of customization options. With the ability to track your income and expenses, allocate your income to different categories, and monitor your progress, you can take control of your finances and make informed decisions about your money.

Remember that budgeting is a continuous process that requires discipline, consistency, and flexibility. Review and adjust your budget regularly as needed to ensure it aligns with your financial goals and current circumstances. With dedication and perseverance, you can master your finances and achieve your desired financial freedom.

- 10 Free Educational Printouts for Kids to Improve Learningby riahi

- Rococo Influence on Fashion: 5 Stunning Ways It Shaped Styleby riahi

- 5 Rococo Painting Techniques That Will Transform Your Brushwork Elegantlyby riahi