Achieving financial happiness is much more than having a lot of money; it’s about managing your finances smartly and efficiently. Smart budgeting is a crucial tool in this journey. It not only helps you keep track of your income and expenses but also paves the way for financial security and peace of mind. In this article, we’ll explore five proven strategies that can help you achieve financial happiness through smart budgeting.

Understand Your Financial Picture

Assessing Your Current Financial Situation

The first step towards Achieving Financial Happiness is getting a clear picture of your current financial status. This involves understanding your income, expenses, debts, and savings. Creating a detailed budget helps in identifying areas where you’re overspending and where you can save more. It’s essential to be honest with yourself during this assessment.

Set Realistic Financial Goals

Aligning Goals with Financial Capacity

Setting realistic financial goals is a cornerstone of smart budgeting. Whether it’s saving for a house, preparing for retirement, or simply building an emergency fund, having clear goals gives purpose to your budget. Make sure these goals are achievable and aligned with your financial capacity. Break them down into short-term and long-term goals to make the process more manageable.

Prioritize Your Spending

Identifying Needs vs. Wants

One of the most effective budgeting strategies is learning to differentiate between needs and wants. Needs are essential expenses like rent, groceries, and utilities, whereas wants are non-essential like dining out, entertainment, and luxury items. By prioritizing your spending on needs and limiting expenses on wants, you can manage your budget more effectively and save more.

Utilize Budgeting Tools and Apps

Leveraging Technology for Efficient Budgeting

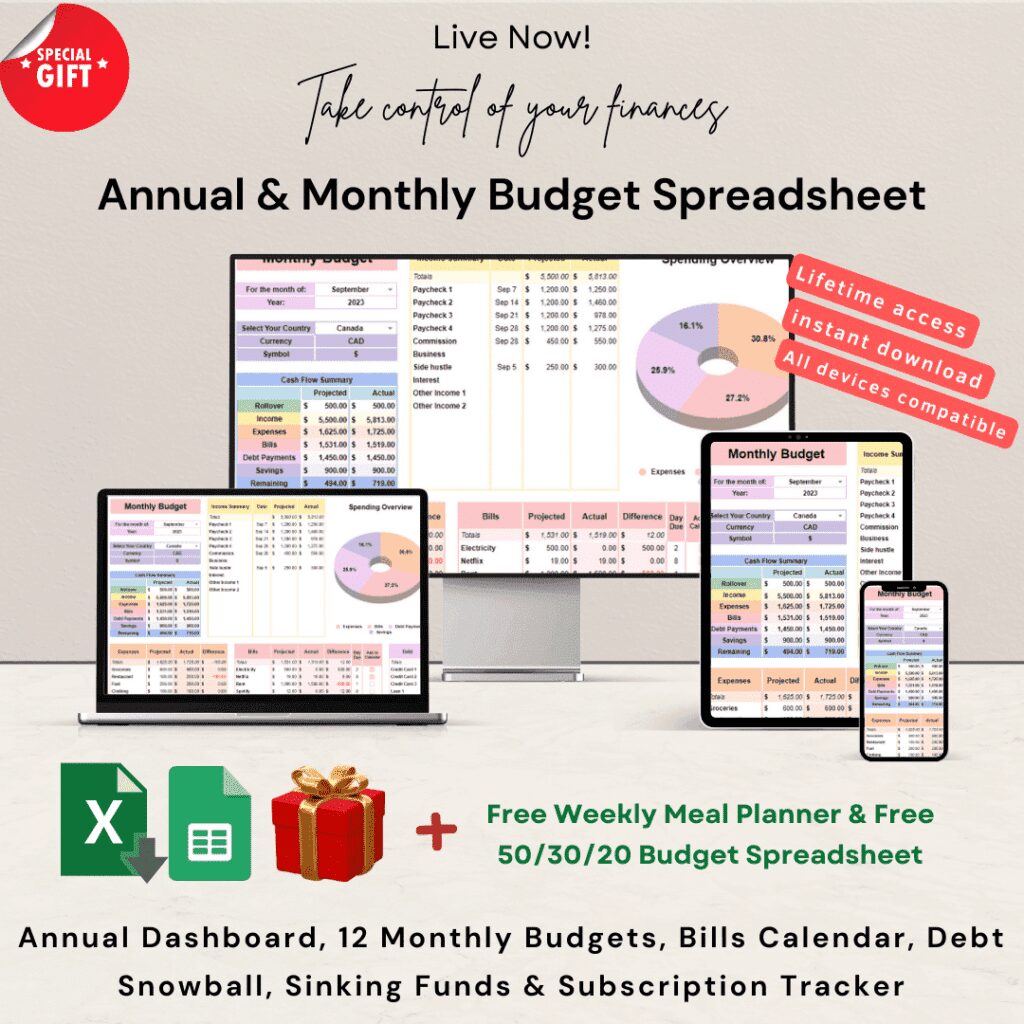

In today’s digital era, numerous tools and apps can help you budget and track your expenses efficiently. These apps often categorize your spending, send alerts for bill payments, and provide insights into your financial habits. Utilizing these tools not only simplifies the budgeting process but also helps in maintaining a more accurate and up-to-date financial overview.

Join the thousands who have already transformed their financial management with our apps. It’s time to experience the convenience and effectiveness of digital budgeting. Click the button below to get started and take the first step towards a more financially savvy you. Your journey towards financial clarity and freedom is just one click away!

Start Your Budgeting Journey Now

Annual Monthly Budget Spreadsheet Template

🔹 Detailed expense tracking and savings planner

🔹 Set and monitor personal financial goals

🔹 Free bonus guide with professional budgeting tips

🔹 Perfect for individuals and families seeking financial clarity

Review and adjust your budget regularly to Achieving Financial Happiness.

Adapting to Financial Changes

Your financial situation can change over time due to various factors like a change in income, unexpected expenses, or economic shifts. It’s important to review and adjust your budget regularly to adapt to these changes. This helps in staying on track with your financial goals and ensures that your budget remains relevant and effective.

FAQs on Smart Budgeting

- How often should I review my budget?

It’s a good practice to review your budget monthly. This helps in making necessary adjustments based on your financial activities each month. - Can budgeting help in debt reduction?

Absolutely. Budgeting allows you to allocate funds towards debt repayment more systematically and can accelerate the debt reduction process. - Is it necessary to use a budgeting app?

While not necessary, budgeting apps can make the process more efficient and provide valuable insights into your spending habits. - How do I handle unexpected expenses while on a budget?

Setting aside a portion of your income for an emergency fund can help handle unexpected expenses without disrupting your budget. - Can budgeting help with retirement planning?

Yes, budgeting is an essential tool in retirement planning. It helps in allocating funds towards your retirement savings consistently. - What’s the best way to stick to a budget?

The key is consistency and commitment. Regularly tracking your expenses and being mindful of your spending habits are crucial.

Conclusion: Embracing Financial Well-being through Budgeting

In conclusion, smart budgeting is not just about tracking where your money goes. It’s a strategic approach to managing your finances that leads to Achieving Financial Happiness. By understanding your financial picture, setting realistic goals, prioritizing spending, using budgeting tools, and regularly reviewing your budget, you can achieve a more secure and satisfying financial life. Remember, the path to Achieving Financial Happiness is a journey, not a destination, and smart budgeting is your reliable guide on this journey.